In the fast-paced world of high-growth SaaS companies, having access to real-time metrics is vital for making informed decisions. A strong foundation in bookkeeping and finance forms the bedrock of obtaining accurate and up-to-date financial insights. In this blog post, we’ll explore key elements to consider when building an effective bookkeeping process for SaaS companies.

1. Sales Tax Tracking via Payment Gateways: For SaaS companies utilizing various payment gateways like Stripe, PayPal, and others, accurately capturing sales tax is a crucial bookkeeping requirement. Since high-volume SaaS transactions often lack corresponding invoices, it can be challenging to calculate the sales tax collected. To address this, a well-defined process is necessary to separate and track sales tax from deposits received.

Methods for Sales Tax Tracking for SaaS Companies:

- Utilize Stripe Reports: Export transactional reports from Stripe and filter them by location (province or state) to back out the appropriate sales tax.

- Automate using Zapier: Set up Zapier to create rows in a Google Sheet from Stripe charges, conveniently organizing transaction locations for easy tracking.

- Employ Quaderno: Connect to Quaderno, which aggregates sales taxes by region and provides comprehensive reports, simplifying the tax tracking process.

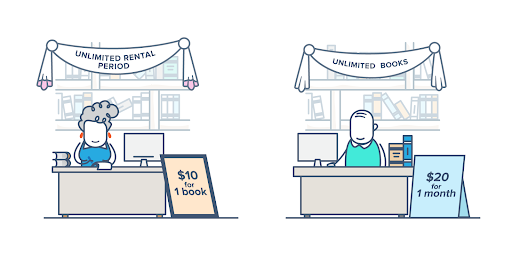

2. Handling Deferred Revenue: SaaS companies often offer discounts for customers paying in advance for annual services. To ensure accurate financial reporting, accrual accounting comes into play. Rather than recording the full amount as revenue upfront, deferred revenue allows for a smoother recognition of income over the period of service.

Methods for Deferred Revenue:

- Employ Spreadsheets: Create a spreadsheet to track all revenue-generating annual transactions and use formulas to divide the amounts over the specific service period.

- Flowrev Integration: Connect your accounting system to the Flowrev app, automatically populating revenue based on service periods.

- Zapier Integration: Utilize Zapier to automate deferred revenue rows and schedules into a Google Sheet for further calculations.

3. Payroll Accruals: For venture-funded SaaS companies with stringent reporting requirements, accounting on an accrual basis is necessary. Payroll accruals ensure that expenses are recorded in the month they were incurred, providing a holistic view of month-over-month performance. Additionally, companies with bi-weekly pay periods can experience fluctuations in the payroll expense category, requiring adjustments or switching to semi-monthly payroll.

Benefits of Payroll Accruals:

- Accurate Expense Recording: Matching expenses and revenues to the month they are incurred/earned provides a clearer financial picture.

- Holistic View of Performance: Accrual-based accounting enables a more comprehensive assessment of the company’s monthly performance.

Leveraging Real-Time Metrics for Success In the high-growth world of SaaS companies, access to real-time metrics is critical for making well-informed decisions and ensuring optimal financial performance. By establishing robust bookkeeping processes and leveraging automation tools, such as Zapier and Quaderno, SaaS companies can achieve accurate financial reporting and gain valuable insights into their business operations. Harnessing real-time metrics empowers leadership teams to make strategic pricing and hiring decisions and fosters confidence in the viability of their business models. With organized financial statements in place, SaaS companies are better equipped for forecasting and securing investment for continued growth and success.

In the ever-evolving landscape of high-growth SaaS companies, staying ahead of the curve with precise financial insights is the key to thriving. By implementing efficient bookkeeping practices and embracing technology-driven solutions, SaaS companies can pave the way to continued prosperity and success.

Also read: How Can Outsourcing Accounting Benefit Small Business in Canada?

Software as a Service (SaaS) companies are revolutionizing industries with their cloud-based solutions. While these businesses focus on delivering innovative software to their clients, they must also manage their financial health. Proper bookkeeping and accounting are essential for SaaS companies to track revenue, control expenses, and maintain compliance with tax regulations. In this guide, we will explore the unique aspects of bookkeeping and accounting for SaaS companies.

1. Chart of Accounts

A well-structured chart of accounts is the foundation of your SaaS company’s financial management. It categorizes all financial transactions, making it easier to track revenue streams, expenses, and assets. Common categories for SaaS companies include subscription revenue, setup fees, hosting costs, employee salaries, marketing expenses, and research and development expenses.

2. Revenue Recognition

Revenue recognition is a critical accounting aspect for SaaS companies. Since SaaS businesses often provide services over an extended period, recognizing revenue accurately and in compliance with Generally Accepted Accounting Principles (GAAP) is essential.

For subscription-based SaaS companies, revenue is typically recognized over the subscription period, usually monthly or annually. Ensure your accounting system can handle deferred revenue and amortization to accurately account for subscription income.

3. Subscription Metrics and KPIs

SaaS companies rely on key performance indicators (KPIs) and metrics to assess their financial health. These may include Monthly Recurring Revenue (MRR), Customer Acquisition Cost (CAC), Customer Lifetime Value (CLV), Churn Rate, and Gross Margin. Tracking these metrics provides insights into the sustainability and growth potential of your business.

4. Expense Tracking

Managing expenses is crucial for profitability. SaaS companies should track both fixed and variable expenses. Common expenses include hosting and infrastructure costs, employee salaries and benefits, marketing and advertising expenses, software development costs, and office overhead.

Implement expense tracking systems and categorize expenses to identify areas where cost-saving measures can be applied.

5. Cash Flow Management

SaaS companies should maintain healthy cash flow to fund operations, invest in product development, and ensure financial stability. This involves monitoring cash flow statements, managing accounts receivable and payable, and planning for capital expenditures.

6. Taxes and Compliance

Tax compliance is a complex aspect of accounting for SaaS companies. Depending on your jurisdiction and business structure, you may be subject to different tax regulations. These may include Value Added Tax (VAT), Goods and Services Tax (GST), or Sales Tax. Work closely with a tax professional or accountant familiar with SaaS taxation to ensure compliance.

7. Accounting Software

Investing in robust accounting software is crucial for SaaS companies. Cloud-based accounting platforms like QuickBooks, Xero, or FreshBooks offer features tailored to SaaS needs, such as subscription billing, revenue recognition, and expense management.

8. Monthly and Annual Close

SaaS companies should perform monthly and annual financial closes to reconcile accounts, verify balances, and ensure accurate financial reporting. These processes help identify discrepancies, prevent fraud, and maintain financial transparency.

9. External Reporting

SaaS companies often need to provide financial reports to investors, lenders, or stakeholders. These reports should follow standard accounting principles and provide a clear overview of the company’s financial performance.

10. Seek Professional Guidance

Navigating the complex world of SaaS accounting requires expertise. Engage with an experienced accountant or financial advisor with knowledge of SaaS industry practices and regulations. They can provide valuable insights, ensure compliance, and help optimize your financial management strategies.

Conclusion

Proper bookkeeping and accounting are fundamental to the success and growth of SaaS companies. By maintaining accurate financial records, adhering to industry-specific revenue recognition guidelines, and tracking key performance metrics, SaaS businesses can make informed decisions, attract investors, and stay competitive in the dynamic software industry. Remember that financial management is an ongoing process, and continuous monitoring and adjustment are essential to adapt to changing market conditions and drive sustainable growth.