The Income Tax Act distinguishes between various sources of income such as wages, dividends, interest, and capital gains. However, there are certain types of income that don’t fit into any of these categories on your tax return (line 13000).

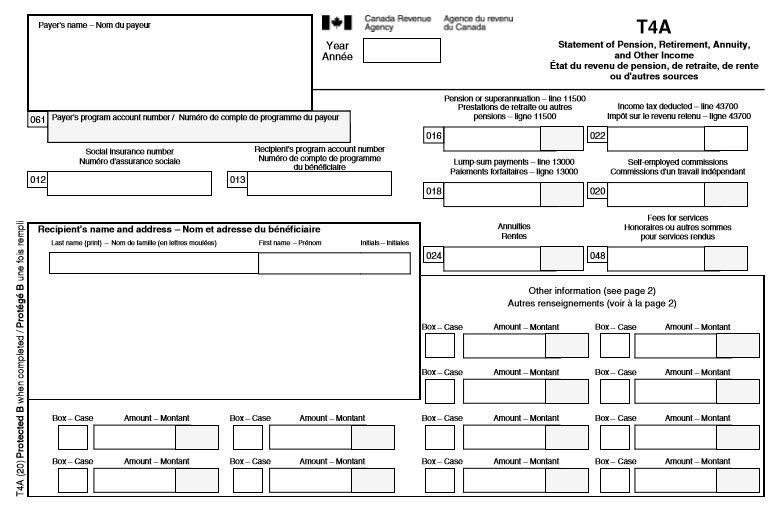

T4A slip

The T4A slip is a Statement of Pension, Retirement, Annuity, and Other Income. It summarizes the information from all T4A slips issued to each recipient for the calendar year. In Canada, box 106 on the T4A slip shows the total amount for Line 13000 on the tax return.

T3 slip

The T3 slip, which is also known as the Statement of Trust Income Allocations and Designations, is utilized by trusts to identify beneficiaries and provide financial information regarding the income and credits allocated to them. In Canada, Box 26 on the T3 slip reflects Line 13000 on the tax return.

What is line 13000 on the tax return?

Line 13000 on the tax return, also known as “Other kinds of income”, refers to any taxable income that has not been reported elsewhere or that does not fit into any other category. Prior to the 2019 tax year, it was known as line 130. This line should be used to report any income items that cannot be reported elsewhere on your return. When reporting on line 13000, provide a description of the type of income being declared.

Examples of income that should be reported on that include taxable scholarships, fellowships, bursaries, and grants for artists’ projects. Other examples include payments from a RESP, training grants, incentive grants for apprenticeships, retirement compensation plan payments, and tax-free savings account benefits.

If you received a T4A slip, any amount reported in box 130 should be reported on line 13000. Additionally, if you have multiple sources of income, you should include a letter outlining each one with your paper return.

In conclusion

The Income Tax Act provides different categories for various sources of income, but if your income does not fit in any of those categories, you should report it on line 13000 of your tax return. Additionally, on line 13010, you should report taxable scholarships, fellowships, bursaries, and grants for artists’ projects. To ensure accurate reporting, make sure to indicate the type of income you are reporting in the box to the left of it. If you have multiple sources of income, it may be helpful to include a letter with your paper return outlining each one.